Paper Money History

Paper Money History

Paper currency first developed in Tang dynasty China during the 7th century but true paper money did not appeared 11th century. In the year 812, the Chinese Emperor used it as a temporary solution because of the copper shortage.Later the usage of paper money spread throughout the Mongol Empire or Yuan dynasty China.

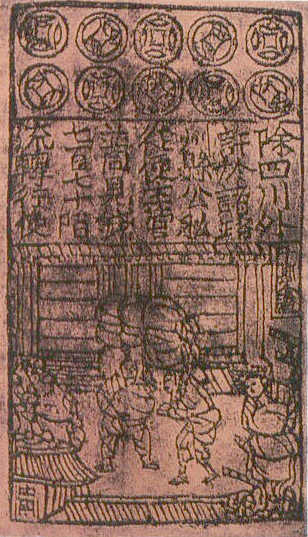

By 960, the Song government was short of copper for striking coins, and issued the first generally circulating notes.True paper money, called “jiaozi”, developed from promissory notes by the 11th century, during the Song dynasty.

Jiaozi, the world’s earliest paper money

The issue of credit notes was often for a limited duration, and at some discount to the promised amount later. The Jiaozi did not replace coins but was used alongside them.The central government soon observed the economic advantages of printing paper money.By the early 12th century, the amount of banknotes issued in a single year amounted to an annual rate of 26 million strings of cash coins.The Emperor Huizong of Song decided to lessen the amount of paper taken in the tribute quota, because it was causing detrimental effects and creating heavy burdens on the people. However, the government still needed masses of paper product for the exchange certificates and the state’s new issuing of paper money. For the printing of paper money alone, the Song government established several government-run factories in the cities of Huizhou, Chengdu, Hangzhou, and Anqi. It was recorded in 1175 that the factory at Hangzhou alone employed more than a thousand workers a day.

After 1107, the government printed money in no less than six ink colors and printed notes with intricate designs and sometimes even with mixture of a unique fiber in the paper to combat counterfeiting.

The geographic limitation changed between 1265 and 1274, when the late southern Song government issued a nationwide paper currency standard, which was backed by gold or silver.The range of varying values for these banknotes was perhaps from one string of cash to one hundred at the most.

European explorers like Marco Polo introduced the concept in Europe during the 13th century after his trip to China.

In medieval Italy and Flanders, because of the insecurity and impracticality of transporting large sums of cash over long distances, money traders started using promissory notes. In the beginning these were personally registered, but they soon became a written order to pay the amount to whomever had it in their possession. In the 14th century, it was used in every part of Europe and in Italian city-state merchants colonies outside of Europe. For international payments, the more efficient and sophisticated bill of exchange (“lettera di cambio”), that is, a promissory note based on a virtual currency account was used more often.

In the mid-17th century, as the price revolution, ,the goldsmith bankers of London began to give out the receipts as payable to the bearer of the document rather than the original depositor. This meant that the note could be used as currency based on the security of the goldsmith, not the account holder of the goldsmith-banker. The bankers also began issuing a greater value of notes than the total value of their physical reserves in the form of loans, on the assumption that they would not have to redeem all of their issued banknotes at the same time. This pivotal shift changed the simple promissory note into an agency for the expansion of the monetary supply itself. As these receipts were increasingly used in the money circulation system, depositors began to ask for multiple receipts to be made out in smaller, fixed denominations for use as money. The receipts soon became a written order to pay the amount to whoever had possession of the note. These notes are credited as the first modern banknotes.

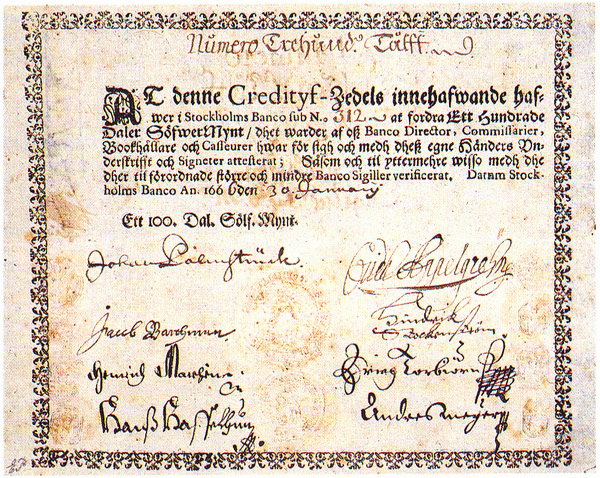

The first short-lived attempt at issuing banknotes by a central bank was in 1661 by Stockholms Banco, a predecessor of Sweden’s central bank Sveriges Riksbank. These replaced the copper-plates being used instead as a means of payment.Three years later, the bank went bankrupt, after rapidly increasing the artificial money supply through the large-scale printing of paper money

First Paper Money in Europe -Sweden Creditfy Zedels

Bank of England was the first bank to initiate the permanent issue of banknotes Established in 1694 to raise money for the funding of the war against France, the bank began issuing notes in 1695 with the promise to pay the bearer the value of the note on demand. They were initially handwritten to a precise amount and issued on deposit or as a loan. There was a gradual move toward the issuance of fixed denomination notes, and by 1745, standardized printed notes ranging from £20 to £1,000 were being printed. Fully printed notes that did not require the name of the payee and the cashier’s signature first appeared in 1855.

One year after the founding of the Bank of England, the Bank of Scotland was initiated. It held the bank note monopoly for Scotland until 1717.

Also in Norway, which at the time was a Danish province, in 1695 the businessman Thør Møhlen, circulated banknotes (without interest) with the approval of the government. The notes had 5 wax seals. Unfortunately the population didn’t find them acceptable and brought them immediately to the bank to cash them in. As a result, Thør Møhlen came into financial difficulty.

France also began printing paper money in the year 1703 under Louis XIV. Because of uncertainties connected with paper money, other states waited until the late 19th century.

In the United States there were early attempts at establishing a central bank in 1791 and 1816, but it was only in 1862 that the federal government of the United States began to print banknotes.Commercial banks in the United States had legally issued banknotes before there was a national currency; however, these became subject to government authorization from 1863 to 1932. In the last of these series, the issuing bank would stamp its name and promise to pay, along with the signatures of its president and cashier on a preprinted note. By this time, the notes were standardized in appearance and not too different from Federal Reserve Notes.

In 1833 the second in a series of Bank Charter Acts (England) established that banknotes would be considered as legal tender during peacetime.

The Bank Charter Act of 1844, which established the modern central bank, restricted authorisation to issue new banknotes to the Bank of England, which would henceforth have sole control of the money supply in 1921. At the same time, the Bank of England was restricted to issue new banknotes only if they were 100% backed by gold or up to £14 million in government debt. The Act gave the Bank of England an effective monopoly over the note issue from 1928.

In Hong Kong, three commercial banks are licensed to issue Hong Kong dollar notes,and in Macau, banknotes of the Macanese pataca are issued by two different commercial banks.

In Luxembourg, the Banque Internationale à Luxembourg was entitled to issue its own Luxembourgish franc notes until the introduction of the Euro in 1999.

As well as commercial issuers, other organizations may have note-issuing powers; for example, until 2002 the Singapore dollar was issued by the Board of Commissioners of Currency Singapore, a government agency which was later taken over by the Monetary Authority of Singapore.